A concoction of higher costs and lower returns has incentivized pension funds around the world to explore creative solutions, largely in artificial intelligence (AI) and other technologically enabled strategies, to help them manage their money as efficiently as possible.

The largest pension fund in the world, the Japanese Government Pension Investment Fund (GPIF) with ¥158trn (€1.2trn) in assets under management, is no exception. Around 20% of GPIF’s assets are actively managed, but during the 2014-16 period, they did not outperform their targets. In November 2017 the fund launched a study together with Sony Computer Science Laboratories to explore AI’s impact on asset management. At that time, they were explicit in their intention to “explore whether AI technologies could be used to reconcile asset managers’ explanations of their investment decisions and the actual track record of trading data.”

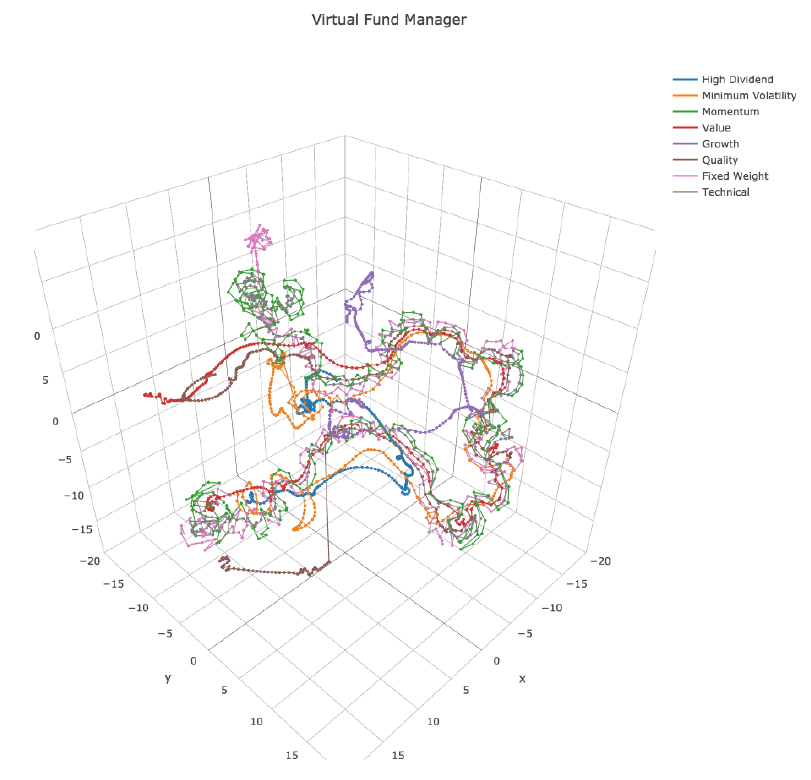

A proof-of-concept pilot system was developed to test the principle of using deep learning to detect the investment style of managers from trading behavior data (trading items, timing, volume, unrealized gain and losses). The system was composed of a series of ‘detector arrays’, each reacting to the specific style of each manager. Essentially, eight investment logic elements were used to virtually map out manager’s activities relative to a specific fund. Fascinatingly enough, this notion of a virtual fund manager was represented visually in a Summary Report published in March:

The Summary Report concluded that GPIF should indeed be able to conduct more prudent and data-driven selection and monitoring of fund managers using the AI system. They are hoping that this will “foster more constructive and in-depth dialog between GPIF and fund managers, which will improve the performance of their long -term investment practices.”

In accordance with their peers in Japan, new results of the Fidelity Global Institutional Investor Survey reflects similarly high expectations of technological impact on core operations. According to the survey, 79% of respondents believe that technology will fundamentally change how the financial industry functions, and 50% believe that investment allocations will be made without any human contact from asset managers.

However, while GPIF has the means to conduct their own pilot study, most institutional investors do not have such a luxury. While it is clear that they know change is coming, just one out of ten survey respondents had already incorporated AI into their investment processes.

Institutional investors in the Netherlands – widely known to have one of the most advanced pension systems in the world – are also grappling with how best to handle this technological shift. The sixth annual Bismarck-lezing, hosted by the Netherlands Investment Managers Forum (NIMF) on 15 November, will address the role and impact that innovation has on the Dutch pension sector. Their questions can be considered a barometer for the sector as a whole: how much of these changes will actually innovate our sector? What will the impact of these changes be? Will innovation and digital transformation usher in desired improvements?